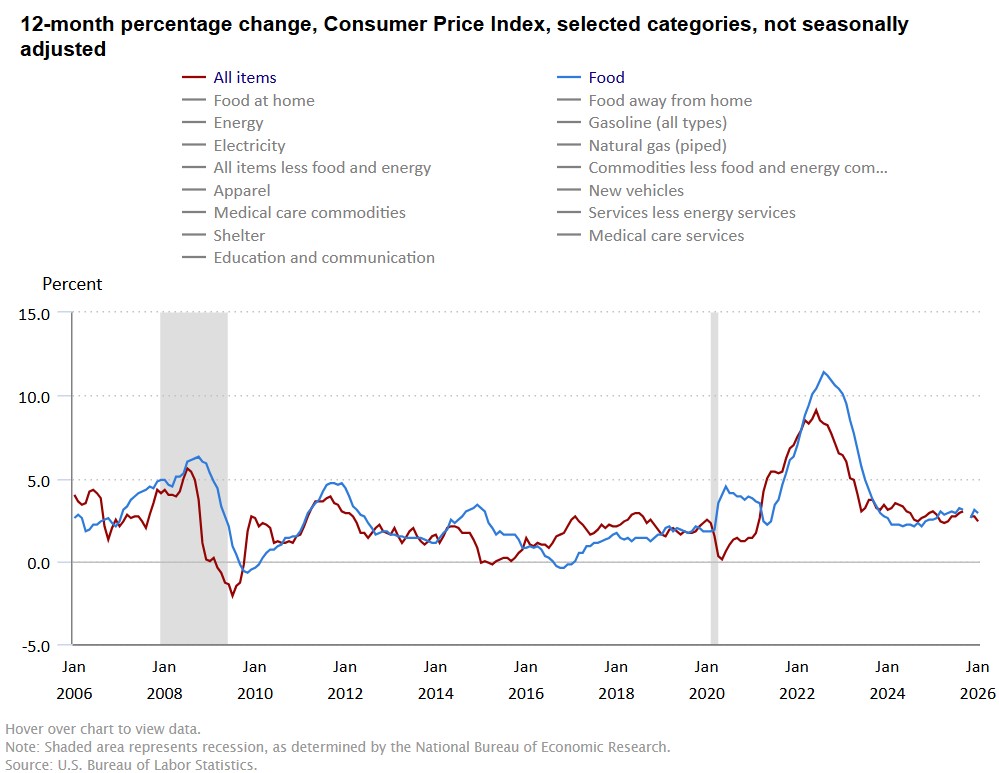

The February 13, 2026, CPI report for January was generally considered good, as inflation cooled more than expected to a 2.4% annual rate, marking a five-year low by some measures. The report showed a modest 0.2% monthly increase, providing relief to investors and indicating a continued downward trend despite some sticky core inflation.

Key Takeaways from the January 2026 CPI Report:

Headline Inflation: Rose 0.2% monthly and 2.4% annually, both below expectations.

Core CPI: (Excluding food and energy) fell to a 2.5% annual rate, the lowest since early 2021.

Housing Costs: Continued to cool, helping to offset other price pressures.

Market Impact: The better-than-expected data eased fears of a re-acceleration of inflation, with traders pricing in a 51% chance of a Federal Reserve rate cut by June.

While some economists noted that "core" inflation and certain goods (like apparel and electronics) still show price pressures, the overall consensus is that the data is encouraging and represents a positive sign for the economy.