Derrell S. Peel, Oklahoma State University

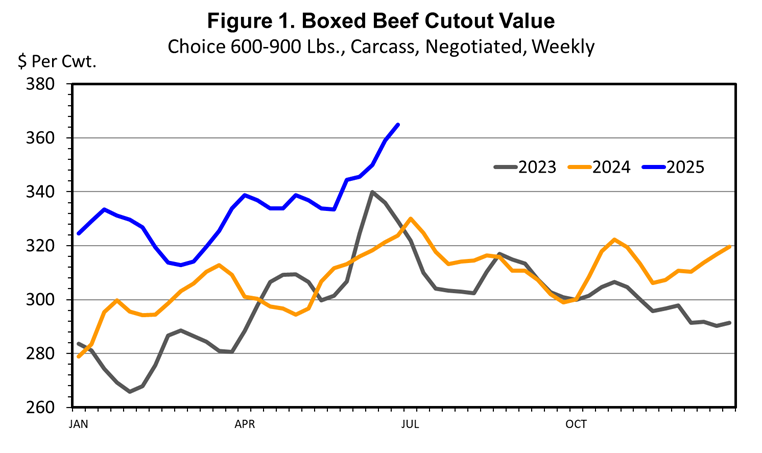

Strong seasonal demand and recent decreases in beef production have pushed beef prices sharply higher recently. The last week May, Choice boxed beef price was $364.92/cwt., up 16.5 percent year over year and has increased 7.7 percent in just the last seven weeks (Figure 1). Cutout values typically increase to a seasonal peak in May but the increase this year has been more pronounced than usual owing to generally strong beef demand and recently declining beef production. The increase in boxed beef cutout values from March to May has been roughly twice the normal seasonal increase over this period.

Table 1 below summarizes changes in cattle slaughter and beef production for the year-to-date and recent weeks. Slaughter and beef production have begun to decrease with total beef production down for the last seven consecutive weeks for a total decrease of 4.4 percent year over year. The big change is fed beef production, which was higher in 2024 and is still 1.2 percent higher year over year for the year to date but is down six of the past seven weeks for a total decrease of 3.3 percent compared to the same period one year ago. In the last seven weeks, total fed (steer plus heifer) slaughter is down 5.6 percent with steer slaughter down 5.5 percent and heifer slaughter down 5.8 percent year over year. This contrasts with 2024 when steer slaughter was up 0.4 percent and heifer slaughter was down a scant 0.3 percent year over year leading to total fed slaughter up 0.3 percent for the year.

Nonfed beef production continues the decline of the past two years. In the first 19 weeks of 2025, nonfed beef production is down 9.7 percent year over year, following a decrease of 12.7 percent last year. Thus far in the year, total cow slaughter is down 12.8 percent with dairy cow slaughter down 8.4 percent and beef cow slaughter down 17.0 percent.

Table 1. Cattle Slaughter and Beef Production Change, % of Previous Year

The decrease in nonfed beef production is reflected in the trimmings market. The current price of 90 percent lean trimmings is $383.41/cwt., up 8.3 percent over last year. The recent decrease in fed slaughter has also pushed prices for 50 percent lean trimmings sharply higher, with the latest weekly price at $126.91/cwt., up 67.1 percent year over year. A 5:1 ratio of 90s to 50s – which produces an 83.3 percent blend – is currently valued at $340.66/cwt., up 10.7 percent year over year.

Articles on The Cattle Range are published because of interesting content but don't necessarily reflect the views of The Cattle Range.