The combination of lower retention of beef heifers as replacements plus a lower culling rate of beef cows equals an older beef cow herd.

The January Cattle report confirms historically tight supplies of cattle heading into 2025. However, some relief was provided in the form of a larger calf crop in 2024 than previously expected and the reintroduction of Mexican feeder cattle into the supply chain beginning in February. Projected beef production in 2025 is raised to 26.565 billion pounds, up 775 million pounds from last month. This is based on increased cattle supplies available for placement and heavy cattle slaughter weights early in the year being carried forward.

Slaughter cattle prices in 2025 are raised on firm demand and the fact that cattle available for placement in feedlots will still be less than last year despite more feeder calves being available than previously expected. This year’s import forecast is unchanged from last month at 4.770 billion pounds. However, export projections are raised from last month to 2.795 billion pounds on increased beef production available for export.

Cattle Report Marks 50-Year Decline in Herd Size, Which Is Likely To Linger

The USDA National Agricultural Statistics Service (NASS) released its Cattle report on January 31st. The total of all cattle and calves1 on January 1, 2025, was estimated at 86.662 million head, about 0.5 million fewer than the previous year. This marks the 6th year of contraction for aggregate beef and dairy cattle inventories and the 11th year overall of the current cattle cycle - the cyclical expansion and contraction of the national cattle herd over time. The cycle is influenced by the combined effects of cattle prices, input costs that drive cow-calf producer profitability, the gestation period for cattle, the time needed for raising calves to market weight, and climate conditions.

Beef cows, the largest class of cattle estimated in the Cattle report, are particularly affected by the factors affecting the cattle cycle and the subsequent driver of year-to-year changes in cattle inventory. The number of beef cows on January 1 declined 0.5 percent from last year to 27.864 million head. The culling rate of beef cows in 2024 was over 10 percent of the beef cow inventory on January 1, 2024, a 2-percentage point decline from last year and the lowest since 2019.

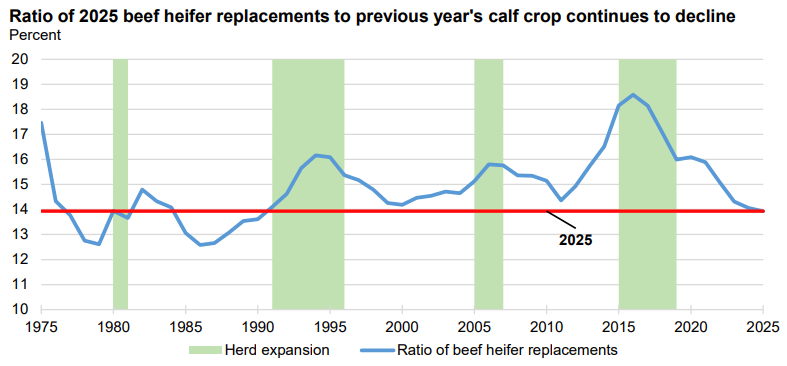

Estimated retention of beef heifers was only 4.672 million head, 1 percent less than last year. For additional context, the number of beef cows is down 39 percent from the historic peak set in 1975 of 45.712 million head and is the smallest beef cow inventory since 1961. As the number of beef heifers available for addition to the herd is correlated to the size of the beef cow herd and the previous year’s calf crop, beef heifer replacements also peaked in 1975 at 8.884 million head and have since fallen 47 percent. In the last three cattle cycles, including the beginning of the current cycle, the percent of beef heifers kept for replacements in the coming year has had several years of year-over-year increasing proportions compared to the previous year's calf crop. If the same pattern holds in the future, it could be several years from now before the U.S. cattle herd expands. Biologically speaking, many of the offspring from heifers born in 2024 would not enter the beef cow herd until the 2027 Cattle report. Historically high prices for calves likely encouraged many producers to market their heifer calves to the feeder market in 2024.

Beef Import Forecast

The beef import forecast for 2025 remains unchanged from last month at 4.770 billion pounds. If realized, this would represent about a 3-percent increase year over year. The chart below shows the quarterly forecasts for 2025. Each quarter is expected to be slightly above 2024 and expected to follow a similar seasonal pattern.

The milk replacement heifer inventory for January 1 was reported at 3.914 million head, about 0.9 percent lower than January 1, 2024. The reported level of replacement heifers is the lowest since 1978. Milk replacement heifers expected to calve totaled slightly below 2.500 million head, 0.4 percent below January 1, 2024. The ratio of replacement heifers to milk cows was 41.9 percent, one of the lowest rates since the early 1990s.