Derrell S. Peel, Oklahoma State University

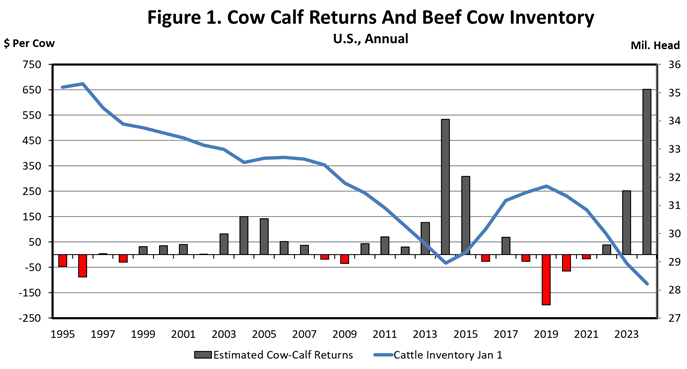

Average Oklahoma steer calf prices increased over 61 percent from 2022 to 2024, leading to a sharp increase in average cow-calf returns (Figure 1). Cow-calf returns vary significantly across producers due to widely variable costs of production, but the message is clear – increasingly strong market signals for cow-calf producers to expand the beef cow herd. Positive cow-calf returns typically result, with a delay, in herd expansion. Figure 1 shows the strong cow herd inventory response to positive returns a decade ago.

New inventory data at the end of the month will confirm current herd status but it is likely that the herd continued to decrease in 2024 and prospects for herd growth in 2025 are limited.

Figure 2 shows a sharp contrast to higher cattle prices leading to the herd rebuild in 2014-2019 compared to the current situation. Heifer retention began in 2012, setting the stage for herd expansion that began in 2014. Increased heifer retention simultaneous with increasing cattle prices squeezed feeder supplies leading to the (then) record feeder prices in 2014 – 2015. Contrast that with the right side of Figure 2 where replacement heifer inventories have shown no significant increase thus far, despite rising feeder cattle prices. Heifer slaughter data through the end of the year, along with heifer on-feed inventories and feeder cattle sales receipts data all suggest little, if any heifer retention in 2024.

Not only did the beef cow herd likely get smaller in 2024, but the limited supplies of replacement heifers also suggests that the beef cow herd may get smaller yet in 2025 or, at best, stabilize at very low inventories. Historically, herd expansions require a year or two to gain momentum before herd inventories begin to increase. That process has not begun at this time.

If heifer retention begins in 2025, several outcomes are expected; tighter feeder supplies will push cattle prices and cow-calf returns higher; retained heifer calves will lead to increased replacement heifer inventories in 2026 and potential herd growth beginning in 2027. Depending on the pace of heifer retention, herd expansion could lead to cyclical production increases and price peaks in the second half of the decade.

If heifer retention does not begin in 2025, the cow herd will continue to dwindle, and cattle supplies will continue to slowly contract with higher cattle prices and a smaller industry until herd rebuilding begins. Either way, cattle prices are expected to remain elevated for at least two to four more years.