Sources: Russell Knight and Hannah Taylor, USDA; ERS

Earlier this year, it was expected that the number of cattle on feed would shrink year over year in the second half of 2024, based on smaller inventory levels at the beginning of the year, and that year-over-year higher calf prices would result in retention of heifers, limiting numbers in the feedlot. However, the October Cattle on Feed report, published by USDA, National Agricultural Statistics Service (NASS), estimated the October 1 feedlot inventory at 11.600 million head, nearly flat from 11.604 million head for the same month last year. Feedlot net placements1 in September were 2 percent lower year over year at 2.100 million head. Placements more than offset marketings in September, which registered 1.698 million head, up 2 percent year over year. As a result, the number of cattle on feed on October 1 has been relatively flat since 2021 despite declining cattle inventories since 2019.

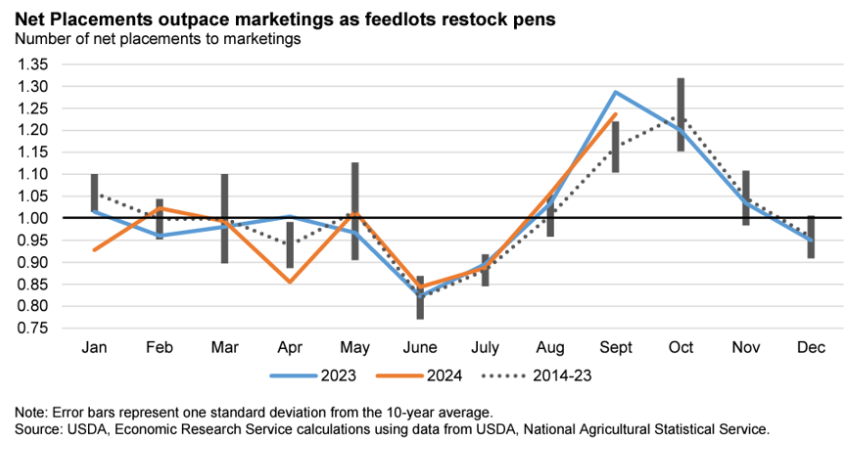

Despite the relatively high price of feeder calves, the chart below shows that the number of net placements to marketings has outpaced the 10-year average by more than one standard deviation for the months of September and August. When combined with a slower year-over-year pace of marketings, it has pushed the percent of cattle on feed over 150 days above year ago levels. It also suggests a larger supply of fed steers and heifers that will be marketed in the coming quarters.

The October Cattle on Feed report provides a breakdown of the number of steers and heifers on feed. The number of steers on feed was slightly above last year, but heifers were almost 1 percent below last year. For the first time since July 1, 2023, there are fewer heifers on feed than a year ago, though not by much, which suggests that producers were not intent on retaining a substantial number of heifers. In the chart below, note that heifers on feed on October 1st are still above average for the current herd contractionary phase and the downturn of the previous cattle cycle (2007–2014). Moreover, heifers on feed have averaged about 13 percent more on October 1 than in the previous contractionary phase.

Based on weekly import data from the USDA, Agricultural Marketing Service (AMS), imports of heifers from Mexico for the third quarter are up by more than 45 thousand head, or 61 percent, from the same period last year. Although September imports of heifers from Mexico were down about 5 percent from September 2023, the relatively high number of heifer imports in the third quarter suggests that the number of heifers on feed on October 1 are likely supported by imported heifers, particularly of Mexican origin.